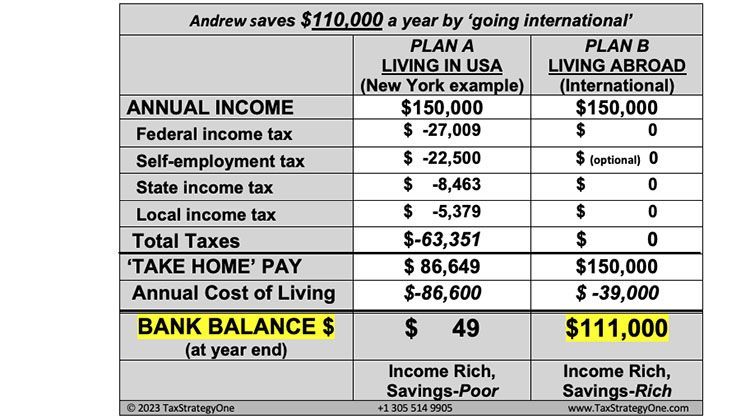

Case Study: Andrew Before and After His Tax-Reduction Plan

$100,000 of investable money every year—on the same base salary.

Meet Andrew. Two years ago when living in the U.S., Andrew was 'Income Rich but Cash Poor' . High taxes and the high cost of living in the U.S. left him little for savings or investments back then. Andrew’s life changed when he called us for a personalized tax-reduction plan. He calls it his “Plan B,” and our 'go international' tax plan provides him with over $100,000 of extra investable money every year—on the same base salary:

“It's not about what you make; it's about what you keep.”

Using our tax-smart plan, Andrew keeps more of his hard-earned dollars:

• Federal Income Tax: $ 27,000 saved

• Self-employment Tax: $ 22,500 saved (optional)

• State Income Tax: $ 8,500 saved

• Local Income Tax: $ 5,300 saved

• Cost of Living Savings: $ 47,000 saved

By following our international plan, Andrew's annual take-home pay increased by over $63,000 by working remotely from abroad. Andrew also reduced his annual cost of living by over $47,000. So all-in, he's boosted his personal economy by over $100,000 every year.

Think about that. What would you do with all that extra money?

There are also significant non-tax reasons to work and live abroad-- including enhancing your career skills (e.g., new languages), lowering your personal cost of living, finding great healthcare at an affordable cost (many of the recommend countries are centers for medical tourism with US trained doctors); or for other family reasons (e.g., more free time and a better quality of life). Therefore, a lower effective tax rate can be one of the many reasons for moving abroad.

In addition, Andrew can now afford to hire low cost local assistants, which frees him to focus on securing new income-generating clients, while also gaining more free time. Good for Andrew and good for his business.

What's your next move?

- Income Rich/Savings Rich

- Income Rich/Savings Poor

If you’d like to learn more about creating your own tax plan, contact us, and one of our tax strategists will be happy to help.

Note-1: your savings can be even higher when your spouse also qualifies for their own expat tax breaks.

Note-2: Your location choices abroad include nearby tax-advantaged tropical paradises located only a short plane ride from the USA.

Copyright 2020-2023

Tax News You Can Use

Profit and prosper with the best of expert advice on taxes, retirement, personal finance and more - straight to your e-mail.

Sign up for our free monthly Expat tax e-newsletter

No spam, and we do not sell personal information we gather from prospects or clients.