Why Moving to a No-Tax State, like Nevada, Florida, or Texas in Not Enough

You Can Achieve Far More Savings by Taking One More Step and ‘Going International’

Moving to a state like Florida, Nevada, or Texas with no state income tax may seem a tempting prospect for residents in high-tax states such as New York, New Jersey, and California – and many do.

Unfortunately, the savings achieved by those moving to a state with no income tax averages less than $2,000 [Lending Tree].

While you could certainly see higher savings in some cases, you also could end up paying more in total taxes by moving to a state with no state income tax. Your objective is a lower ‘total’ tax burden, so consider all applicable taxes, including income, employment, and property taxes.

For example, Texas is “famous” for having no personal state income tax. In contrast, Colorado has a flat 4.63% individual state income tax rate. So, a person can reasonably deduce Texas is cheaper tax-wise to live in than Colorado. But not so fast!

The most crucial tax principle to realize is that each state must pay its bills one way or another. For example, while Texas has no state income tax, they “pay their bills” with some of the highest property tax rates in the country. Some areas in Texas charge as high as 4% of a home’s value every year.

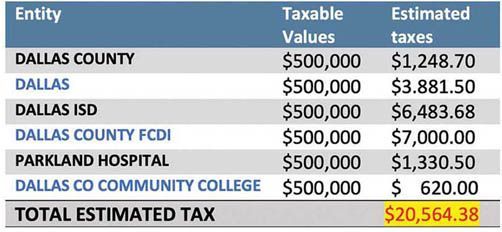

Here’s an example from the Dallas Central Appraisal District's online property tax estimator showing the high property taxes in Texas:

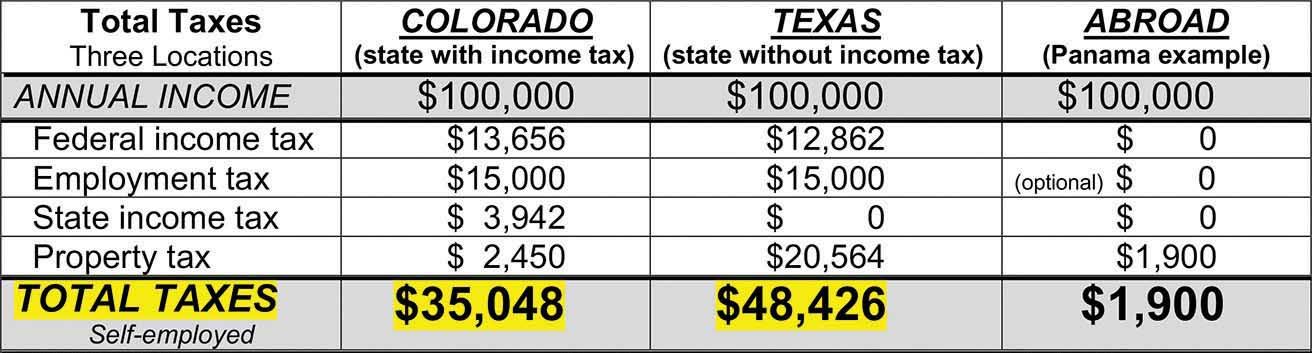

Analyzing the ‘total’ tax burden in three locations

Consider the following client example: A Colorado-based solopreneur with the ability to ‘work from anywhere’ was deciding between moving to Texas or ‘going international.’

The following table analyzes the total taxes at each location—Colorado, Texas, and abroad. This includes federal income tax, state income tax, self-employment tax, and property tax. Then these separate taxes are combined to give the “total tax burden” for each of the three options.

Note: Annual earnings are the same in all three locations ($100K), and each area includes a home (valued at $500K). The ‘total’ tax burden comparison is shown below:

So, are you really saving by moving to a US state with no income tax?

Considering the total tax burdens above, you’d end up paying more in annual taxes by moving to Texas [a state with no state tax]. How much more? About $13,000 higher in Texas each year than in Colorado ($35,000 yearly in Colorado vs. $48,000 annually in Texas).

In Texas, this equates to nearly a 50% combined tax rate! Conversely, ‘go international,’ and you’ll crush your total tax bill to under $2,000! That’s almost $50,000 lower than Texas.

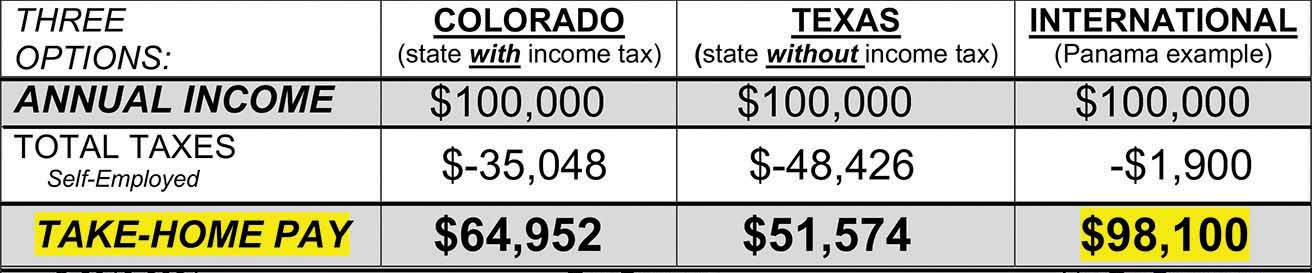

Which is a better ‘financial’ move?

Only one of the three locations above provides a take-home pay that closely matches income—and that’s living abroad. Income at $100K, and take-home pay coming in at $98K. That’s only a 2% tax burden abroad. Conversely, choose Texas, and your take-home pay would only be $51K — a nearly 50% tax burden! ($100K in income, $48K in taxes)—requiring you to work every January to June just to pay your taxes in Texas.

Thus, living and working remotely from abroad can be a financially freeing move.

The recent pandemic changed our perspective on life, leading many to rethink even their best-laid plans. As a direct result, people are moving or considering moving. So, why not move just a little farther to gain financial freedom? If you were to ‘go international’ for only a few years before returning to the US, your family savings account could grow by a quarter of a million dollars or more. That’s big stuff.

Copyright 2020-2023

Tax News You Can Use

Profit and prosper with the best of expert advice on taxes, retirement, personal finance and more - straight to your e-mail.

Sign up for our free monthly Expat tax e-newsletter

No spam, and we do not sell personal information we gather from prospects or clients.